TX Form 4119 2012-2024 free printable template

Show details

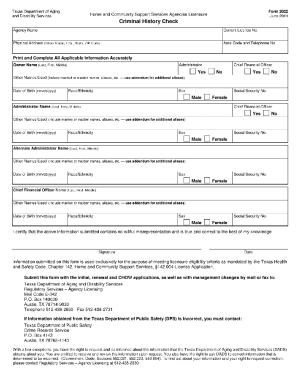

Form 4119 February 2012 Texas Department of Aging and Disability Services Home and Community-based Services Residential Support Services (RSS) and Supervised Living (SL) Service Delivery Log Individual

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your form 4119 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 4119 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form 4119 online

Follow the guidelines below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit form 4119 hcs. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

How to fill out form 4119

01

To fill out form 4119, start by obtaining the form. You can typically find it on the official website of the organization or government agency that requires it.

02

Begin by carefully reading the instructions provided with the form. Understand the purpose of the form and the information it requires.

03

Gather all the necessary documents and information that you will need to complete the form. This may include personal identification, financial records, or any other relevant documents.

04

Start filling out the form by providing the requested personal information. This may include your full name, address, contact details, and any other relevant identification information.

05

Proceed to the sections that require specific information. Each form may vary, but common sections might include financial details, employment history, educational background, or any other relevant information.

06

Double-check the accuracy of the information you have entered. Ensure that everything is complete and correct before moving on.

07

Review any additional instructions provided with the form. It may require you to attach supporting documents or sign certain sections.

08

Once you have filled out the form and attached any required documents, sign and date the form as necessary. Follow any specific instructions regarding the submission of the form, such as mailing it or submitting it online.

Who needs form 4119?

01

Form 4119 may be required by individuals applying for certain benefits or services. The specific organizations or government agencies that require this form may vary depending on the purpose of the form. It is important to check the guidelines or instructions provided to determine if you need to complete this form.

02

The form may be necessary for individuals seeking financial assistance, applying for a license or certification, requesting specific services, or undergoing certain evaluations or assessments.

03

It is always recommended to consult the official guidelines or reach out to the relevant organization or agency to confirm if form 4119 is required in your specific situation.

Fill 4119 feds form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is form 4119?

Form 4119 is a document used by the Internal Revenue Service (IRS) in the United States. It is called the Taxpayer Allocation of $3 of their Payment for the Presidential Election Campaign, and its purpose is to allow taxpayers to allocate $3 of their federal income tax payment to the Presidential Election Campaign Fund. The form provides taxpayers with the option to support the fund, which provides funding for qualified presidential candidates who accept public funding for their campaigns.

Who is required to file form 4119?

Form 4119 is not a recognized form for filing with any specific government agency or authority. Thus, it is not possible to determine who is required to file this form as it does not exist in a formal context.

How to fill out form 4119?

Form 4119 refers to the "Capital Gains and Losses" form used for reporting gains or losses from the sale of assets such as stocks, bonds, real estate, or other investments. Here is a step-by-step guide on how to fill out form 4119:

1. Begin by entering your personal information at the top of the form, including your name, address, and Social Security number.

2. Next, you will need to provide information about the property or investment you sold. Start by entering the description of the property in column (a).

3. In column (b), write the date you acquired the property. In column (c), write the date you sold or disposed of the property.

4. Proceed to fill in the cost or other basis of the property in column (d). This refers to the original purchase price or initial investment including any additional costs like commissions or fees.

5. If you received any adjustments to the cost basis, you can enter them in column (e). Adjustments may include things like depreciation or casualty losses.

6. Calculate the adjusted basis by subtracting any adjustments in column (e) from the cost basis in column (d). Fill in the result in column (f).

7. In column (g), enter the amount you received from the sale or disposition of the property.

8. If you incurred any expenses related to the sale, such as commissions or legal fees, enter them in column (h). However, do not include expenses that are already deducted elsewhere on your tax return (for example, those deducted on Schedule C for business-related expenses).

9. Subtract the expenses in column (h) from the amount received in column (g). Fill in the result in column (i).

10. If column (i) is larger than column (f), you have a gain. Write the gain in column (j). If column (f) is larger, you have a loss. Write the loss in column (k).

11. Transfer the gain or loss to Schedule D of your tax return, as appropriate.

Note: This guide provides a general overview of how to fill out form 4119. However, tax laws can be complex and subject to change. It is always advisable to consult a tax professional or refer to the specific instructions provided by the Internal Revenue Service (IRS) when filling out any tax form.

What is the purpose of form 4119?

Form 4119, also known as the "Statement of Deficiency, Referral, or Recommended Disallowance," is used by the Internal Revenue Service (IRS) for various purposes related to tax audits, examinations, and investigations. The purpose of this form is to inform taxpayers about identified deficiencies in their tax returns, recommend disallowance of claimed deductions or credits, or refer the case for further examination or investigation. It may detail specific issues, calculations, or discrepancies that require clarification or resolution by the taxpayer. The form serves as a notice or communication tool between the IRS and taxpayers regarding potential tax adjustments or penalties.

What information must be reported on form 4119?

Form 4119 refers to the "Information Return Trust Accumulation of Charitable Amounts." It is used by charitable organizations to report financial information on the accumulation of charitable amounts for specific projects or purposes. The following information must be reported on Form 4119:

1. Identification of the organization: The name, address, and Employer Identification Number (EIN) of the charitable organization filing the report.

2. Nature of the trust: A description of the trust or arrangement through which the charitable amounts were accumulated.

3. Contributions received: The total amount of contributions or donations received for the specific project or purpose.

4. Income received: Any income earned or received from the investment or use of the accumulated charitable amounts.

5. Distributions made: The total amount of distributions or expenditures made from the accumulated charitable amounts for the specific project or purpose.

6. Accumulated charitable amount: The remaining balance of the accumulated charitable amounts at the end of the reporting period.

7. Transfers of accumulated amounts: Any transfers or changes to the accumulated charitable amounts during the reporting period.

8. Exempt purpose: A description of the specific charitable purpose or project for which the accumulated funds are being used.

It is important for charitable organizations to accurately report the information on Form 4119 to comply with the tax regulations and maintain transparency regarding the use of accumulated charitable amounts.

What is the penalty for the late filing of form 4119?

Form 4119 is related to the Employer's Quarterly Federal Tax Return. The penalty for the late filing of this form may vary depending on the specific circumstances and the applicable laws. Generally, if you fail to file the form by the due date, you may be subject to a late filing penalty. As per the Internal Revenue Service (IRS) guidelines, the penalty for filing Form 4119 late is usually 5% of the unpaid tax for each month or part of a month the return is late, up to a maximum of 25% of the unpaid tax. However, if the return is more than 60 days late, the minimum penalty can be the smaller of $205 or the total tax amount due. It is important to consult the IRS guidelines or a tax professional for the most accurate and up-to-date information regarding penalties for late filing of specific tax forms.

How can I modify form 4119 without leaving Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your form 4119 hcs into a dynamic fillable form that you can manage and eSign from any internet-connected device.

Can I create an eSignature for the hhsc form 4119 in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your form 4119 pdf right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

How do I complete obsolet 4119 forms on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your 4119 delivery log form. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

Fill out your form 4119 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Hhsc Form 4119 is not the form you're looking for?Search for another form here.

Keywords relevant to tx form 4119

Related to form 4119 online

If you believe that this page should be taken down, please follow our DMCA take down process

here

.